TRANSFORMING INDONESIA’S

SPORTS LANDSCAPE

Breathing New Life into Idle Land with Purposeful Returns

FUND SUMMARY

UNLOCK EXCEPTIONAL RETURNS WITH GARUDA SPORTS GROUP

Garuda Sports Group is dedicated to shaping Indonesia’s future through world-class sports and wellness infrastructure.

Backed by Asiantrust Capital and Prasetia Dwidharma, and in strategis partnership with Doogether⎯ a proven operator in the sports and wellness sector⎯ the fund focuses on high-growth urban areas to meet the surging demand for healthy, active living spaces.

With a robust cash flow model, diversified project portfolio, and solid fundamentals, Garuda Sports Group targets project-level returns of up to 30% IRR. It offers investors a rare opportunity to combine high impact development with attractive financial returns in Indonesia’s rapidly expanding wellness economy.

WHY INVEST WITH US

FUELED BY INDONESIA'S INCREASING

FOCUS ON HEALTH AND WELLNESS

Further accelerated by the post-COVID-19 era, we’ve identified a significant growth trajectory in the demand for high-quality sports facilities. Similar to the development patterns seen in other rapidly expanding areas, there’s a unique opportunity to revitalize underutilized assets across Indonesia by transforming them into vibrant sports centers.

Our investment is strategically positioned to capitalize on this growth, with targeted returns indicating an estimated project level IRR of around 30% per annum over a 7-year horizon. This outlook presents a unique opportunity for substantial investments in Indonesia’s burgeoning sports sector, allowing us to leverage the increasing demand and deliver strong returns.

Our investment strategy focuses on a diversified portfolio of sports facilities, ensuring a balanced approach to risk and return. This is coupled with expert management and strategic partnerships to maximize facility usage and ancillary revenue streams.

We seek to efficiently deploy capital to seize this timely opportunity and maximize profitability within Indonesia’s dynamic sports and wellness market.

RISK MANAGEMENT

OUR RISK MANAGEMENT

SOURCING UNDER-UTILIZED ASSETS

Identifying and sourcing under-utilized prime assets in collaboration with our partners and stakeholders.

1

Legal Due Diligence

Ensuring thorough legal due diligence to mitigate potential legal pitfalls and safeguard investors as well as operators against legal challenges.

2

SELECTION OF QUALITY ASSETS

Selecting high-quality assets is fundamental to our investment, providing a strong buffer against various risks, including liquidity constraints and economic downturns.

3

VALUE CREATION

Engaging Strong Operational Partners Is Key To Unlocking An Asset’s Full Potential, Addressing Operational Gaps, And Driving Value Creation To Stabilize And Enhance Asset Performance.

4

DIVERSITY OF INVENSTMENTS

diversifying Across Different types Of Sports And Wellness And Changing The Asset mix to Reflect The Best Opportunities Boosting Returns And Minimizing Risks.

5

TIMELINE

OUR TIMELINE

KEY PERFORMANCE INDICATORS

OUR KEY PERFORMANCE INDICATORS

10

NUMBER OF FACILITIES/

LOCATION BUILT

50

NUMBER OF COURTS OPERATED

50 Bio IDR

ASSETS UNDER

MANAGEMENT (AUM)

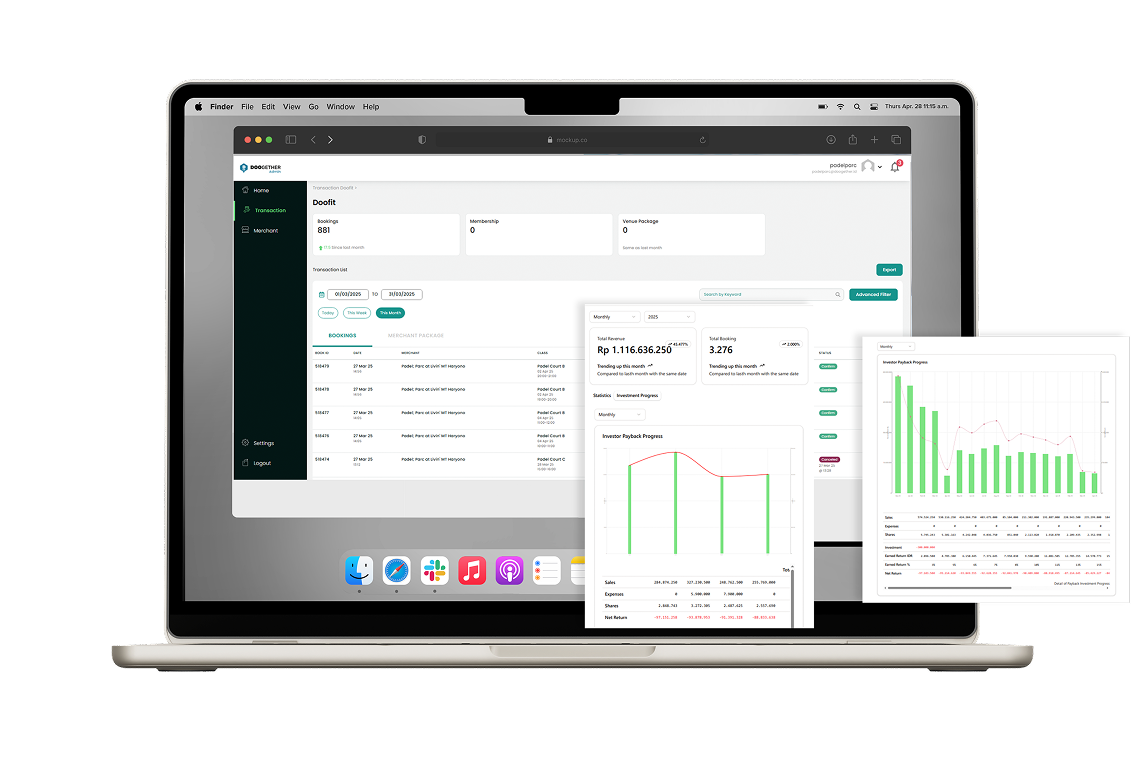

INVESTOR DASHBOARD

DASHBOARD

Gain real-time insights into your investments with our intuitive and powerful investor dashboard. Monitor performance, track progress, and make data-driven decisions — all in one place.